RPGTA was launched on November 7 1975 to replace the 1974 Land Speculation Tax Act. As proposed by Tengku Datuk Seri Zafrul Abdul Aziz the RPGT rates as per Schedule 5 of the Real Property Gains Tax Act 1976.

Real Property Gains Tax Is No More Businesstoday

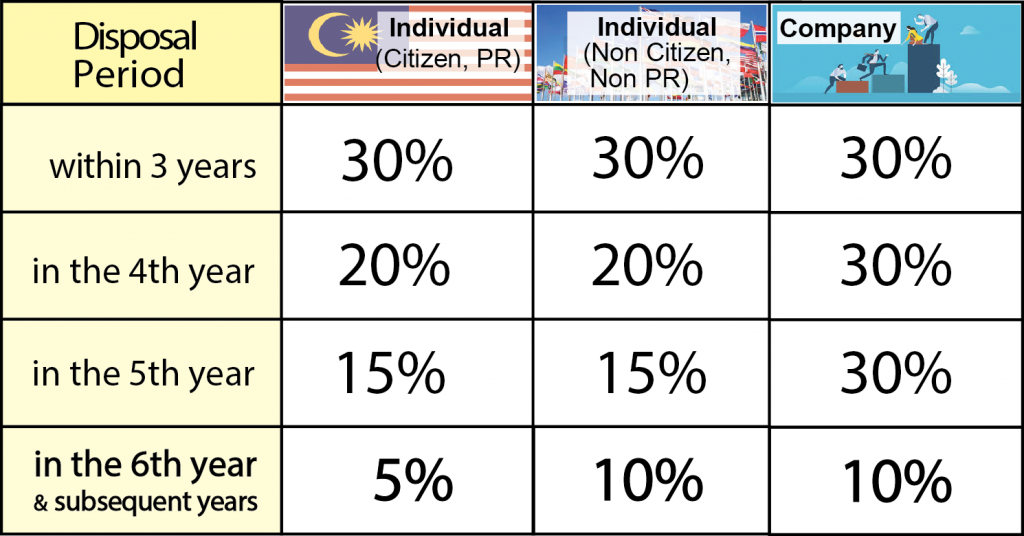

2 Non-citizens and non-permanent residents and companies not incorporated in Malaysia 3 - Society registered under the Societies Act 1966 wef 1 January 2022 consists of body of persons registered under any written law in Malaysia 4 - RPGT rates for disposals made in the 6th year and subsequent years reduced to 0 wef.

. The tax is levied on the gains made from the difference between the disposal price and acquisition price. According to the Real Property Gains Tax Act 1976 RPGT is a form of Capital Gains Tax in Malaysia levied by the Inland Revenue LHDN. In Malaysia if you are selling property or land you will hear this term RPGT or Real Property Gain Tax.

RPGT Form is available at the nearest Inland Revenue Board of Malaysia. What is Real Property Gains Tax RPGT Malaysia. Although it was introduced in 1976 it took 20 years to implement this act.

In 2014 the RPGT was increased for the fifth straight year since 2009. Budget 2022 RPGT Change Removed the 5 RPGT for properties held for more than five years by Malaysian citizens and permanent residents effective 1st January 2022. How to file RPGT in Malaysia.

Disposer and acquirer are exempted from submitting the RPGT Form if disposal of asset is subject to the Income Tax Act 1967 ITA 1967. Both bills were introduced to limit speculation in real estate. Real Property Gains Tax Act 1976 RPGT Act is an Act to provide for the imposition assessment and collection of a tax chargeable on the gains accruing on the disposal or sale of any real property in Malaysia.

It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. A Bad Case For The 7 Retention Sum For RPGT. Malaysian citizens and permanent residents will no longer have to pay RPGT when selling their property on the sixth year onwards.

Malaysian citizens and permanent residents will no longer have to pay RPGT when selling their property on the sixth year onwards. 7 November 1975 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of the Dewan Negara and Dewan. Real Property Gains Tax RPGT is a tax levied by the Inland Revenue Board IRB on chargeable gains derived from the disposal of real property.

The following is the RPGT rates effective from 1 January 2019. How the 7 retention sum came about The 7 retention sum is part of the tax obligation for foreigners selling Malaysia property. Fast forward to 2019 the RPGT rates have been revised.

It is chargeable upon profit made from the sale of your land or real property where the resale price is higher than the purchase price. But what is this. In my previous post I have mentioned that this is a new amendment law to the RPGT by the ex-Finance Minister Mr Lim Guan Eng in 2018 when he was newly elected then.

This tax is provided for in the Real Property Gains Tax Act 1976 Act 169. Budget 2022 RPGT Change Removed the 5 RPGT for properties held for more than five years by Malaysian citizens and permanent residents effective 1st January 2022. Real property is defined to mean any land situated in Malaysia and any interest option or other right in or over such land.

One of the highlights of the Budget 2022 is to remove the Real Property Gains Tax RPGT for the disposal of Real Property 1 by individual citizens and permanent residents starting from the sixth year and above. RPGT by the Real Estate Gains Tax Act 1976 RPGTA 1976. Disposer who apply for exemption under Section 8.

According to the Real Property Gains Tax Act 1976 RPGT is a form of Capital Gains Tax in Malaysia levied by the Inland Revenue LHDN. Malaysia Act 1995 Act 533. An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto.

But first RPGT rates classification. Now theres about to be another revision to the RPGT for under Budget 2020 as well as Exemption Order for 2020. Purpose and significant changes on the RGPT Act RPGT was first introduced in 1976 under Real Property Gains Tax Act 1976 with the objective for the government to prevent a potential bubble and curb any property speculation.

All About Rpgt Real Property Gain Tax 2019 My Awesome Property

Rpgt For Company In Malaysia L The Definitive Guide 2022 Industrial Malaysia

What Is Real Property Gains Tax Rpgt In Malaysia 2021

Real Property Gains Tax Rpgt Act 1976 In Malaysia Download Scientific Diagram

With The New Year Approaching Quickly It Is Imperative To Get Your Things In Order So You Have Ample Time To M Investing Property Investor Investment Property

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

What Is Real Property Gains Tax Rpgt In Malaysia 2021

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Understanding The Concept Of Real Property Gains Tax Rpgt Wma Property

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

What Is Real Property Gains Tax Rpgt In Malaysia 2021

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important